Singapore's Top Debt Consultant with EDUdebt: Customized Solutions for Debt Management

Singapore's Top Debt Consultant with EDUdebt: Customized Solutions for Debt Management

Blog Article

Open the Perks of Engaging Financial Obligation Expert Provider to Browse Your Course Towards Financial Debt Relief and Financial Liberty

Engaging the solutions of a debt consultant can be an essential action in your trip in the direction of attaining financial obligation relief and financial security. These experts provide customized techniques that not just assess your unique monetary conditions however likewise supply the essential assistance required to navigate complex negotiations with creditors. Comprehending the diverse advantages of such competence might expose options you hadn't formerly taken into consideration. Yet, the question remains: what particular benefits can a financial obligation expert bring to your financial situation, and exactly how can you recognize the appropriate companion in this endeavor?

Recognizing Debt Professional Provider

How can debt specialist services transform your economic landscape? Debt specialist solutions supply specialized assistance for individuals coming to grips with financial obstacles. These specialists are educated to examine your monetary circumstance comprehensively, supplying customized strategies that straighten with your unique situations. By analyzing your earnings, debts, and expenses, a financial obligation specialist can help you determine the root causes of your monetary distress, enabling a more exact approach to resolution.

Financial obligation professionals usually use a multi-faceted technique, which may include budgeting help, arrangement with creditors, and the advancement of a tactical settlement plan. They work as middlemans between you and your lenders, leveraging their competence to discuss much more positive terms, such as lowered rates of interest or prolonged settlement timelines.

In addition, financial obligation professionals are outfitted with current knowledge of pertinent legislations and policies, making sure that you are educated of your civil liberties and alternatives. This professional advice not just eases the psychological worry connected with financial obligation but likewise empowers you with the tools needed to restore control of your monetary future. Eventually, engaging with financial debt specialist solutions can cause an extra informed and structured path towards economic security.

Secret Benefits of Specialist Support

Involving with financial obligation expert solutions offers many benefits that can substantially improve your monetary scenario. Among the key benefits is the experience that consultants offer the table. Their substantial knowledge of financial debt management techniques allows them to customize solutions that fit your special scenarios, guaranteeing a more efficient approach to attaining financial security.

Additionally, debt consultants commonly provide settlement help with lenders. Their experience can lead to much more favorable terms, such as decreased rate of interest or worked out debts, which may not be possible with direct arrangement. This can cause considerable economic relief.

Moreover, experts provide an organized strategy for payment, assisting you prioritize debts and allot sources efficiently. This not just simplifies the repayment procedure however likewise fosters a sense of responsibility and progression.

Ultimately, the mix of specialist support, negotiation abilities, structured settlement strategies, and psychological support placements financial debt experts as beneficial allies in the quest of financial obligation alleviation and monetary flexibility.

Just How to Pick the Right Expert

When selecting the ideal financial obligation consultant, what key aspects should you think about to make sure a positive end result? Initially, analyze the consultant's certifications and experience. debt consultant services singapore. Seek certifications from acknowledged companies, as these suggest a degree of expertise and knowledge in the red administration

Following, consider the expert's track record. Research study on the internet evaluations, reviews, and rankings to gauge previous clients' fulfillment. A solid record of effective financial debt resolution is vital.

In addition, review the consultant's approach to financial debt monitoring. A good specialist should provide tailored solutions tailored to your one-of-a-kind financial circumstance as opposed to a one-size-fits-all remedy - debt consultant services singapore. Transparency in their charges and processes is critical; ensure you comprehend the expenses involved before devoting

Communication is an additional vital factor. Pick an expert who is approachable and eager to answer your inquiries, as a strong working relationship can boost your experience.

Typical Financial Obligation Relief Approaches

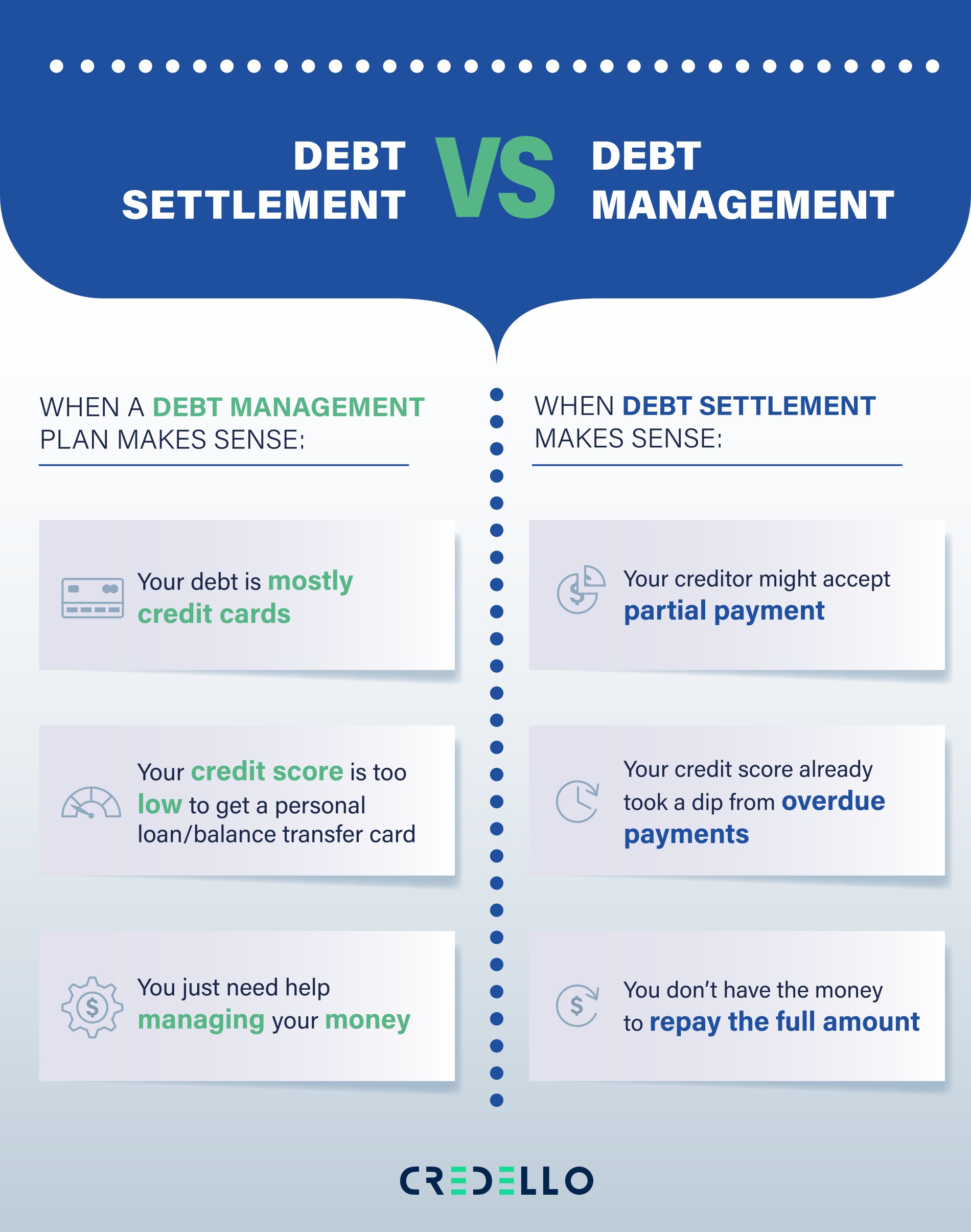

While different financial obligation alleviation strategies exist, selecting the best one relies on specific economic circumstances and objectives. Several of the most usual strategies include financial obligation combination, financial obligation management strategies, and debt settlement.

Debt loan consolidation includes integrating several financial obligations right into a solitary loan with a reduced rates of interest. This method simplifies repayments and can decrease regular monthly commitments, making it easier for individuals to gain back control of their funds.

Financial obligation management plans (DMPs) are created by debt therapy firms. They bargain with creditors to lower passion prices you could try this out and create an organized payment strategy. This option enables people to pay off financial obligations over a fixed period while benefiting from professional advice.

Financial debt negotiation involves discussing straight with financial institutions to settle financial obligations for much less than the total quantity owed. While this technique can offer immediate alleviation, it may affect credit history and commonly involves a lump-sum payment.

Last but not least, personal bankruptcy is a legal alternative that can give remedy for overwhelming financial obligations. However, it has lasting economic implications and should be considered as a last hope.

Selecting the ideal technique requires mindful assessment of one's monetary scenario, ensuring a tailored approach to achieving long-term stability.

Actions In The Direction Of Financial Flexibility

Following, establish a realistic budget plan that prioritizes fundamentals and fosters savings. This spending plan must include arrangements for financial obligation settlement, enabling you to assign excess funds successfully. Adhering to a budget aids cultivate regimented costs habits.

Once a budget plan remains in location, consider involving a financial debt consultant. These experts provide customized techniques for managing and minimizing financial obligation, providing insights that can accelerate your trip toward financial freedom. They might recommend alternatives such as financial debt combination or negotiation with creditors.

Furthermore, focus on developing an emergency situation fund, which can stop future financial strain and supply assurance. Lastly, purchase monetary proficiency with resources or workshops, allowing informed decision-making. With each other, these actions produce a structured method to attaining monetary liberty, transforming ambitions right into truth. With commitment and informed activities, the possibility of a debt-free future is within reach.

Verdict

Involving financial debt consultant services uses a strategic approach to achieving financial debt alleviation and monetary liberty. These professionals provide essential guidance, customized methods, and emotional support while ensuring conformity with pertinent regulations and guidelines. By focusing on financial debts, bargaining with creditors, and applying structured settlement plans, people can reclaim control over their monetary scenarios. Inevitably, the expertise of financial debt specialists dramatically boosts the chance of navigating the intricacies of financial debt management efficiently, bring about a much more protected financial future.

Engaging the solutions of a financial obligation specialist can be a crucial action in your journey towards achieving debt alleviation and financial stability. Financial obligation professional services provide specialized advice for people grappling with financial challenges. By assessing your earnings, financial obligations, and expenditures, a financial debt consultant can help you recognize the root causes find more of your economic click reference distress, permitting for a much more precise approach to resolution.

Engaging financial obligation specialist solutions offers a strategic technique to achieving debt relief and monetary flexibility. Inevitably, the competence of financial debt consultants considerably enhances the chance of navigating the complexities of financial obligation administration properly, leading to a much more safe monetary future.

Report this page